parker county tax assessment

Get driving directions to this office. Watch a video explaining how the Assessors Office does business.

Assessor Douglas County Government

The Parker County Tax Collector is responsible for.

. Discover Parker County Tax Assessor for getting more useful information about real estate apartment mortgages near you. Parker County has one of the highest median property taxes in the United States and is ranked 287th of the 3143 counties in order of median property taxes. This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

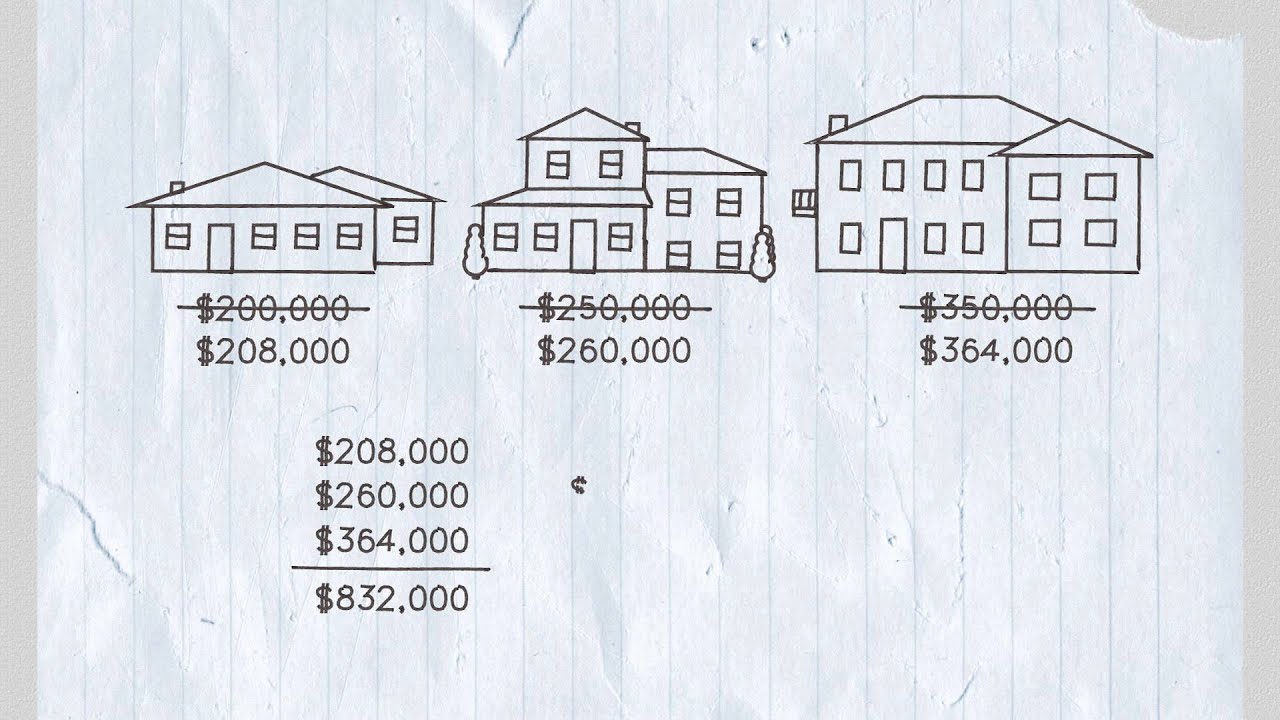

This applies only in the case of residential homestead and cannot exceed the lesser of the market value or the preceding years appraised value plus 10 plus the value of any improvements added since the last re-appraisal. 184-201-15 Weatherford Junior College District. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. 60 DAY OUTDOOR BURN BAN IN. Parker County collects on average 167 of a propertys assessed fair market value as property tax.

1108 Santa Fe Dr Weatherford Texas 76086. Your Douglas County Taxes. Parker County Primary Election results will be posted after 7pm today 312022.

Return to Staff Directory. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX. 184-201-11 Parker County HD.

The property value is an essential component in computing the property tax bills. Visit Our Website Today Get Records Fast. Collecting and reporting all values to the special districts.

Parker County Assessors Office Services. The Park County Assessors Office is responsible for. The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may.

The median property tax on a 14710000 house is 245657 in Parker County. Parker County Tax Office. Search Any Address 2.

Registration Renewals License Plates and Registration Stickers. Ad Search Local Records For Any City. 184-203-40 Parker County ESD 6.

Visit Our Website Today To Get The Answers You Need. County tax assessor-collector offices provide most vehicle title and registration services including. Locating valuing and classifying all taxable property within Park County.

Learn What the Assessor Does. When a county tax assessor does not collect property taxes the county appraisal district may be responsible for. See Property Records Deeds Owner Info Much More.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Parker County TX at tax lien auctions or online distressed asset sales. County Historical Commission Application. Create an Account - Increase your productivity customize your experience and engage in information you care about.

Find All The Records You Need In One Place. 184-202-40 Parker County ESD 3. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office.

The median property tax also known as real estate tax in Parker County is 246100 per year based on a median home value of 14710000 and a median effective property tax rate of 167 of property value. TAX RATE INFORMATION. These buyers bid for an interest rate on the taxes owed and the right to collect back.

184-201-40 Parker County ESD 1. The Parker tax assessor office is also tasked to provide supplemental bills business property taxes and other vital information. DONATIONS FOR EASTLAND COUNTY FIRE VICTIMS.

The Parker county TX tax assessor office provides the necessary services to estimate the real property value within its jurisdiction. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. This tax office does not collect property taxes.

Get In-Depth Property Reports Info You May Not Find On Other Sites. Donations for Eastland County fire victims. Jobs At The White House Washington Dc Cvs 17th Street Washington Dc Rv Campgrounds Near Washington Dc.

Explore a map of where property taxes go throughout Douglas County. Notice of Sale - Tex. Commissioners Court Orders Resolutions.

The median property tax on a 14710000 house is 266251 in Texas. Attorneys Approved for Appointments. 817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas.

The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County. Parker County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Learn about the most recent property value reappraisal.

Parker County TX currently has 125 tax liens available as of March 25. Property Taxes Tickets etc. Parker County Appraisal District.

Property Tax Information Sussex County

A Guide To Your Property Tax Bill Alachua County Tax Collector

![]()

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

Property Tax Calculation Boulder County

How Property Assessment And Taxation Works Youtube

Your Property Value Change And Property Taxes Youtube

Open Cama Solutions How Integration Transforms Property Tax Assessment Farragut

![]()

Home Page Wv Real Estate Assessment

2021 2022 Property Valuation Douglas County Government

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

Financial Risk Assessment Template New Financial Risk Assessment Template Illwfo Schedule Template Guided Reading Lesson Plans Internal Audit

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Assessment Property Tax

Tax Assessor Chester Township Nj

Travis County Texas Property Search And Interactive Gis Map

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy